recent posts

- Achieve Financial Freedom: The Importance of The Number

- Envision Your Financial Future and Plan How to Get There with a Portfolio of Portfolios

- This is Not Your Parents Diversification – Investment STRATEGY Diversification

- Get to Know your Small Business 401(k) Fiduciary…….and Save Millions

- Accelerating Dual Momentum Investing

author

Category: Investment Strategy

-

How much money do you aim to have by when and why? How will you achieve that goal? In this post I will share my vision and plan with specific investment strategies while posing questions to you to help you envision your own financial future and take steps to get there. At the age of…

-

We have all been beaten over the head about portfolio diversification and its benefits. Don’t put all your eggs in one basket is probably the most widely known and respected colloquialism of the investing public. Like the vast majority of people I fully buy into the benefits afforded by the diversification commandment. However, as an engineer…

-

Warren Buffett has said that trying to time the market is the number one mistake to avoid. Market timing is hard, if not impossible to do, as it often results in the investor buying or selling too late or too early rather than right on time. To even consider a market timing strategy is generally frowned…

-

Did our engineered indexes peak your investment interest; but did they still seem a little too risky for what you are comfortable with? In those indexes we pick US stocks on a monthly basis; and we’ve made an effort to pick stocks across uncorrelated sectors. But at the end of the day, they all still…

-

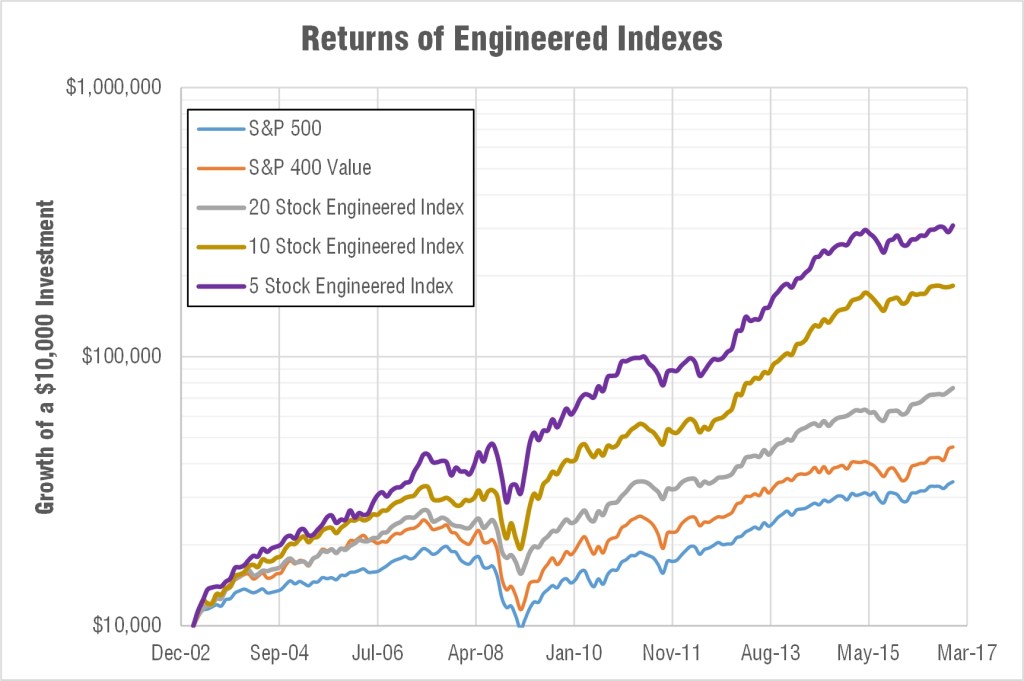

Buying an S&P 500 index fund is boring yet simple. In the world of investing, boring and simple generally means inexpensive yet high returns. But if its too boring, excitement seeking humans (like myself) may opt for “sexier” investment opportunities. The trouble is that sexy stocks and “strategies” are both expensive and their returns are underwhelming. But…

-

Everyone has heard of the investment adage to “buy low, and sell high.” But it’s very difficult to execute in practice. But the mid-cap value index buys low and sells high automatically for its investor. In this blog I’ll explain why this area of the equity market is so proficient. But I won’t stop at some simple…